- Liquid Support

- For Vendors/Contractors

- Compliance as a Vendor

-

General

-

For Businesses

- Getting Started

- Master Contracts / Onboarding Vendors

- Managing Vendors

- Compliance

- Users

- Work Orders

- Work Order Fee Estimates

- Work Order Uploads

- Purchase Orders

- Invoices

- Invoice - Work Order Matching

- Payments

- Invoice Approvals

- QuickBooks Online Integration

- Projects and Accounting Fields

- Reports

- Liquid Plan

- Custom Onboarding / Custom Contracts

- Bank Accounts

-

For Vendors/Contractors

-

Training Videos

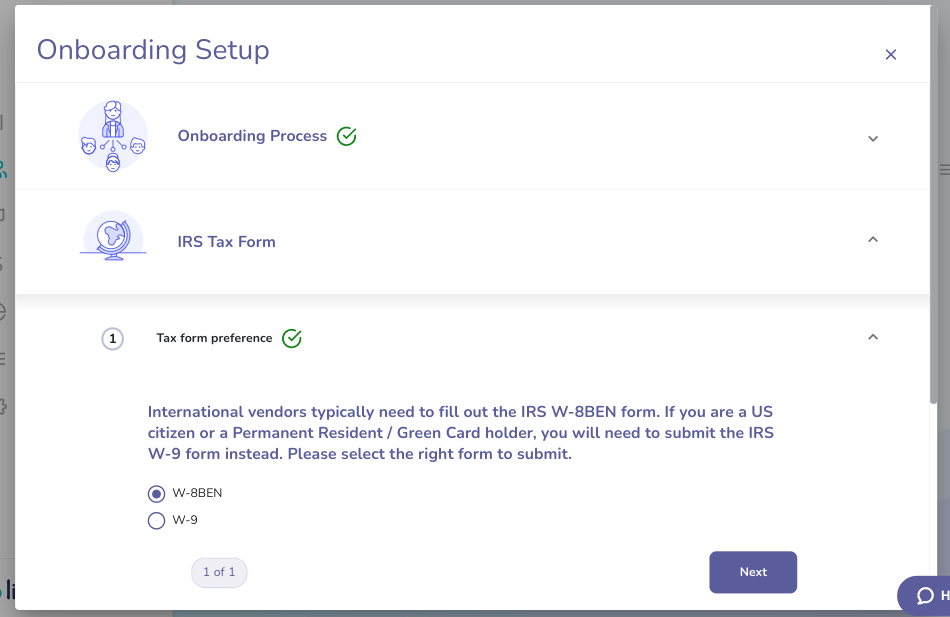

I'm not a US citizen or a US vendor and I don't know why I should fill out an IRS tax form.

US companies must collect W8-BEN forms from non-US citizens and non-US vendors and must collect W9 forms from US citizens and US vendors. You must select and complete one of these two forms to complete the onboarding process your Client has asked you to complete.