If you are an international Vendor using Liquid, you can add your international bank account or your US bank account (including Payoneer, Wise / Transferwise, and other US bank accounts).

The Getting Paid subsection (within the Settings section) allows you to add your bank account, edit your bank account holder information, change your bank account (and select your payout currency for international vendors in countries where we support payments in the local currency).

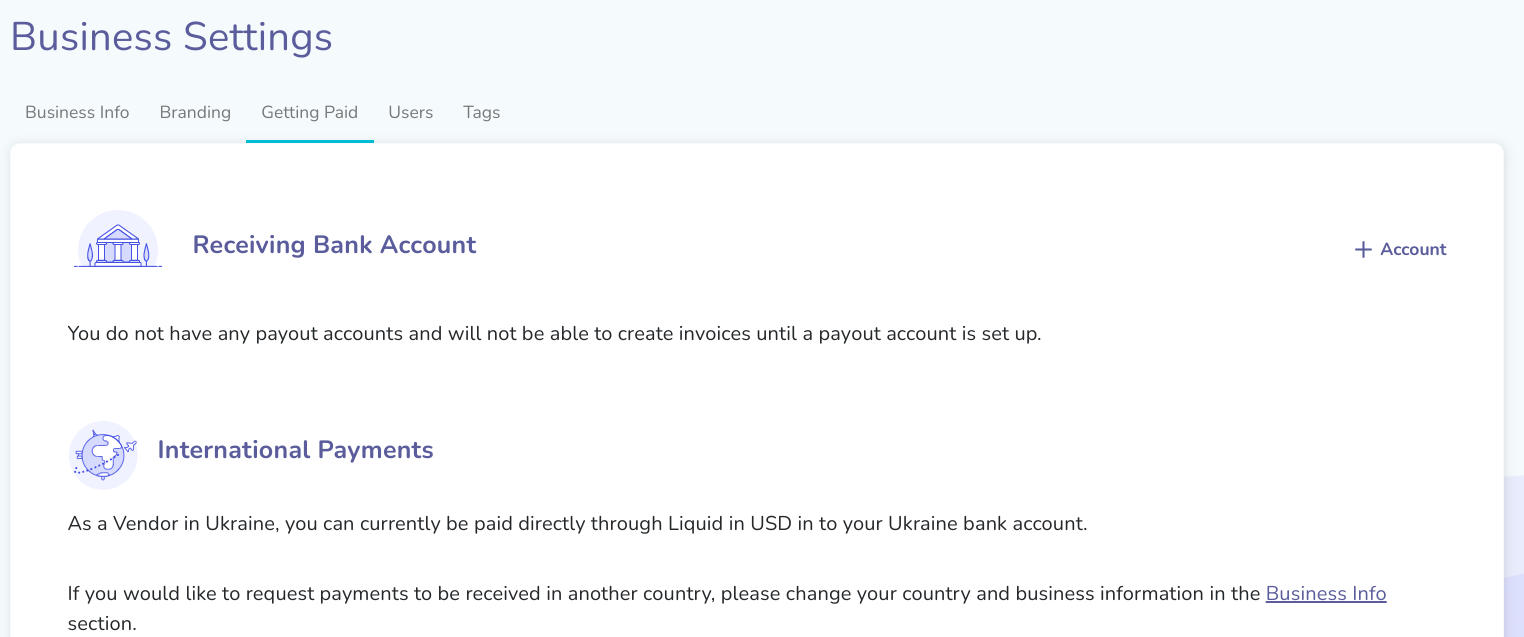

If you have not already added a bank account, the form to begin adding your bank account to Liquid will be shown to you on the Getting Paid subsection. If it does not pop up automatically, you can press the + Account button.

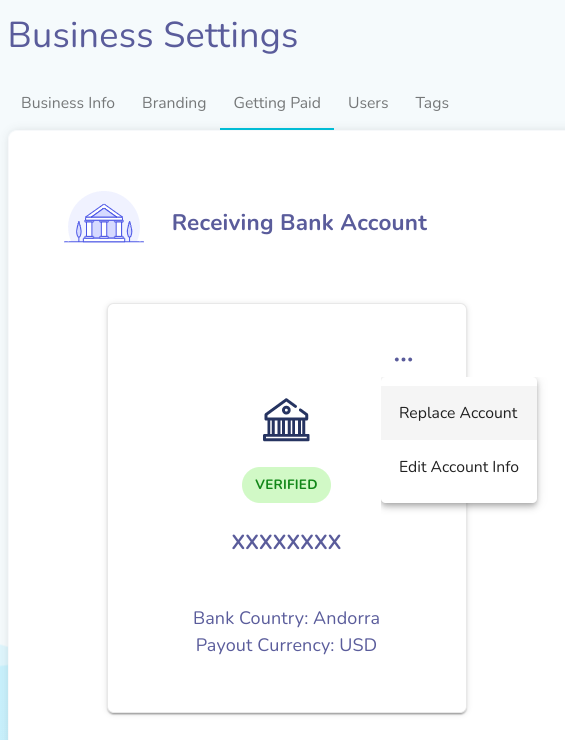

If you have already added a bank account, you'll press the three dots on the bank card to open a dropdown menu; then, press Replace Account.

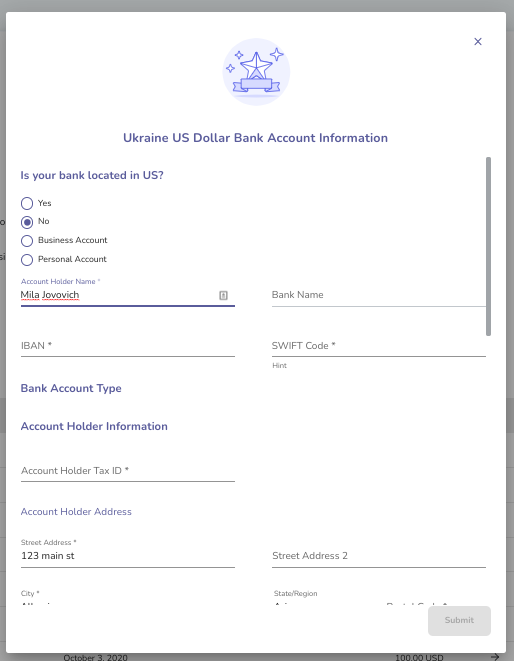

When the international bank account form pops up, you'll initially see the bank account form for the country that matches your address.

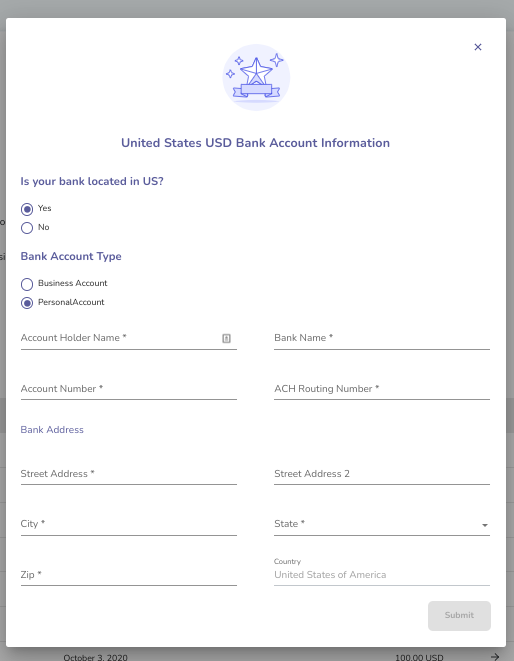

To add your US bank account, select Yes for the question "Is your bank located in US?"

Then, select whether your US bank account is a Business account or a Personal account. Then, complete the other required information:

- Account Holder Name (the person who owns the bank account)

- Bank Name (the name of the bank that the bank account is held at)

- Account Number

- ACH Routing Number

- Bank address

After you have filled out the form, press Submit.

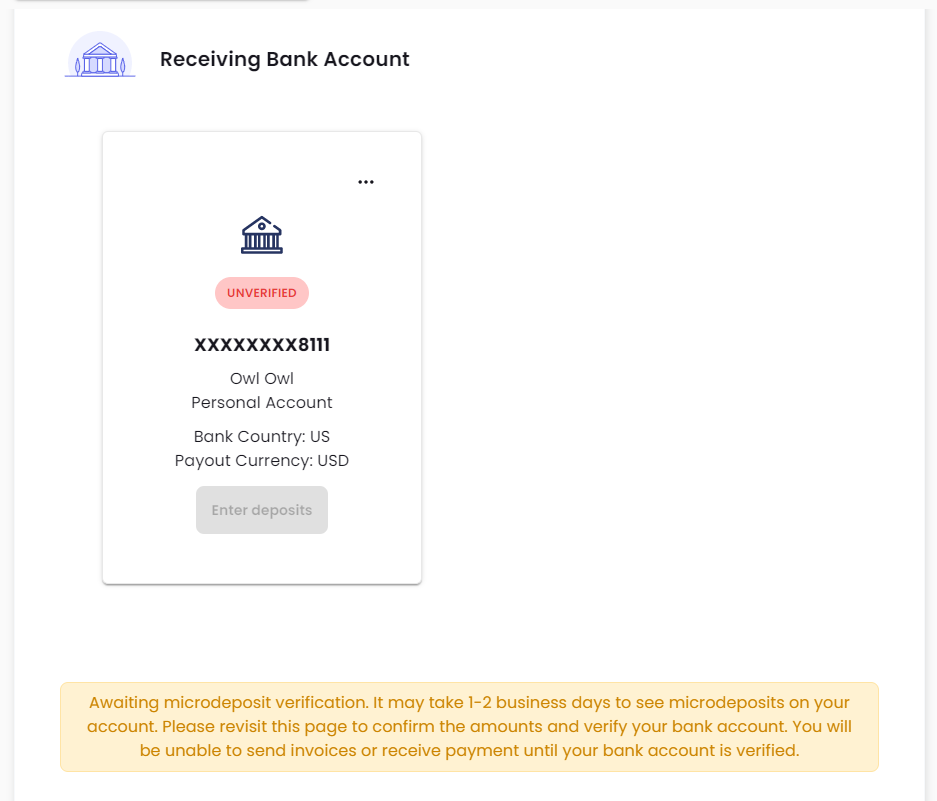

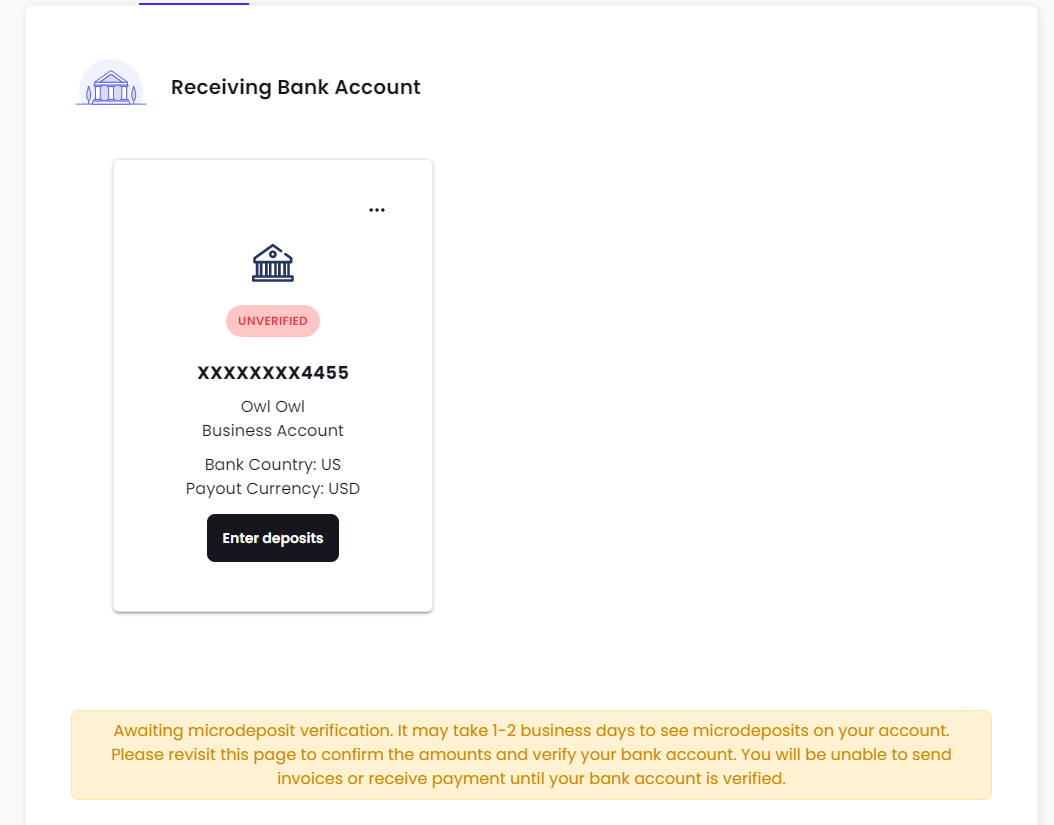

Your account will be marked as Unverified until you enter in the Microdeposit amounts required to verify your account. These amounts may take 1-2 business days to arrive in your account, and the Enter Deposits button will be enabled after the Microdeposits should be in your account.

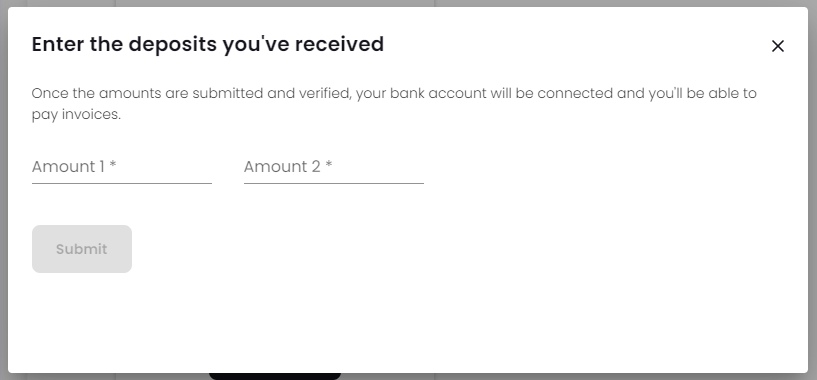

You will receive 2 amounts, both under $1.00 USD each. Select the Enter Deposits button and enter in both amounts in the form to mark your account as Verified.

In addition, our compliance department may reach out to you if any additional documentation is required. Sometimes, our compliance department and banking partners require that we obtain from you a separate document from your bank that proves that you own that bank account (a copy of a bank statement or a letter from your bank is usually sufficient).